Condo Insurance in and around Saginaw

Get your Saginaw condo insured right here!

Cover your home, wisely

- Texas

- Oklahoma

- New Mexico

- Northlake

- Haslet

- Justin

- Blue Mound

- Fort Worth

- Azle

- Keller

- Roanoke

- Tarrant County

- Wise county

- Denton County

Your Search For Condo Insurance Ends With State Farm

As with any home, it's a great idea to make sure you have coverage for your condo. State Farm's Condo Unitowners Insurance has terrific coverage options to fit your needs.

Get your Saginaw condo insured right here!

Cover your home, wisely

State Farm Can Insure Your Condominium, Too

Your home is more than just a roof over your head. It's a refuge for you and your loved ones, full of your personal property with both sentimental and monetary value. It’s all the memories you’ve made there. Doing what you can to help keep it safe just makes sense! That's why one of the most sensible steps is getting a Condominium Unitowners policy from State Farm. This protection helps cover a variety of home-related accidents. For example, what if a gas leak causes a fire or an intruder steals your tablet? Despite the frustration or disappointment from the experience, you'll at least have some comfort knowing your State Farm Condominium Unitowners policy that may help. You can work with Agent Steven Barber who can help you file a claim to help assist paying for your lost items. Preparing doesn’t stop troubles from knocking at your door. Coverage from State Farm can help get your condo back to its sweet spot.

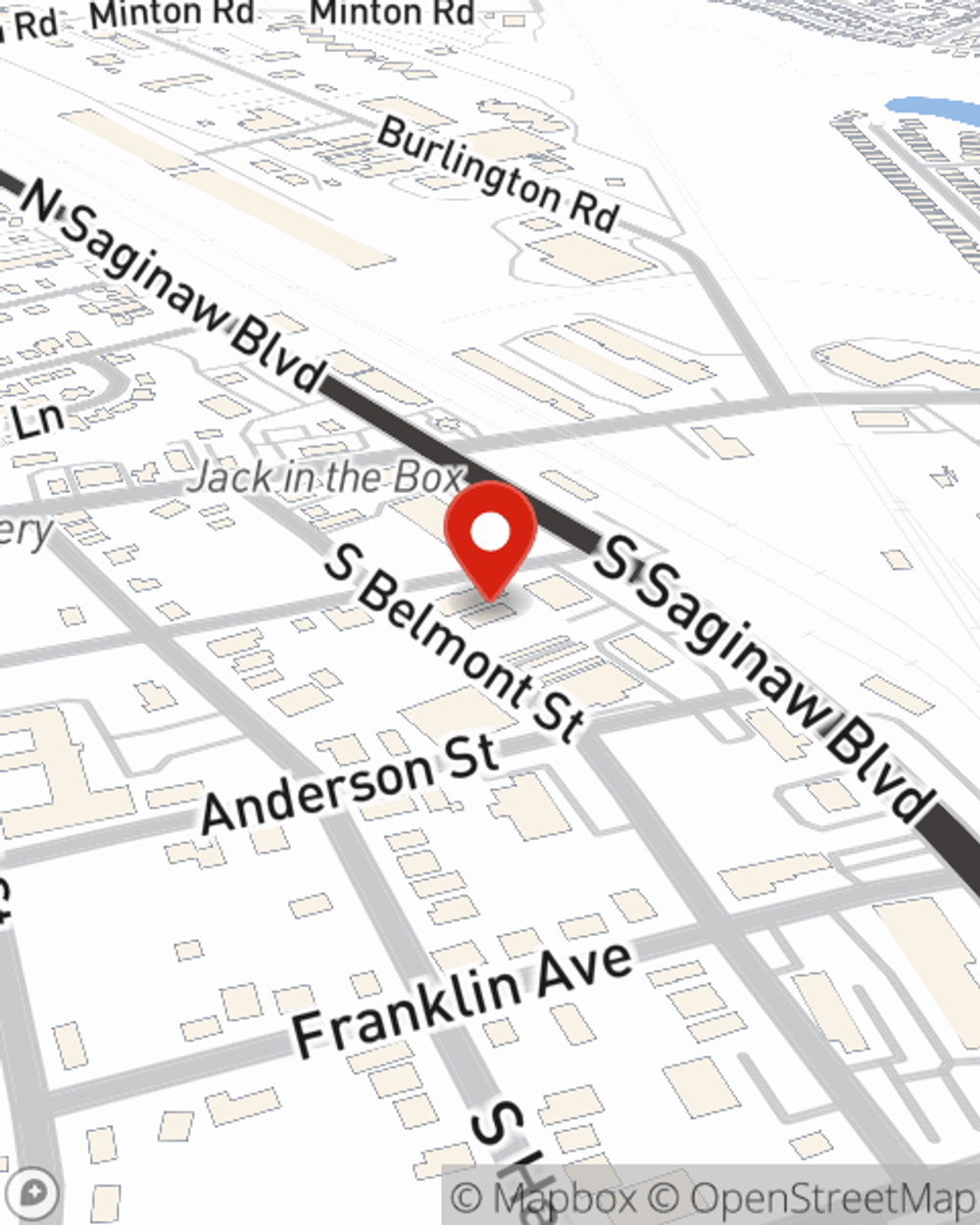

Getting started on an insurance policy for your condominium is just a quote away. Call or email State Farm agent Steven Barber's office to discover your options.

Have More Questions About Condo Unitowners Insurance?

Call Steven at (817) 238-2265 or visit our FAQ page.

Simple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Steven Barber

State Farm® Insurance AgentSimple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.